Debt Free by 40-Garnishment

Debt Free by 40-Garnishment

by Giovanni Hale

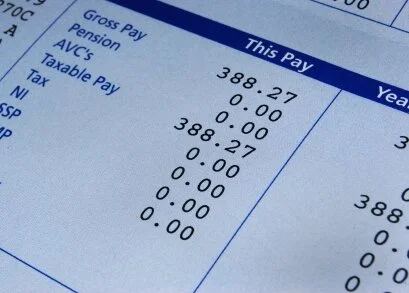

Growing older comes with certain wisdom you learn, over a few years of royally messing things up in your financial health. Finally today I share with you my short but true story about garnishment. While serving on active duty I purchased a 1996 Dodge Ram XLT that I fell in love with from the moment I saw it. That love affair continued for many years until finally after loosing employment and finally running out of savings I was forced to surrender the truck back to the lender. Many months passed and I changed employers but the payment for the truck still needed to be made (to the tune of $4974). Starting my "Debt Free by 40" journey starts on September 8, 2013 but I received notice today that my paycheck is being garnished 25% for the next 12 months until the loan is paid off. So should I be upset at the creditor for going through legal channels to get the money back? or should I place blame on someone or something else for the lack of money? No the blame is sorely and bitterly with me. Now I have to pay for my lack of responsiblity (despite the reason) So my question to other "Debt Free By 40" (DFB40'S) is how do you live on 75% of your take home pay?